Proposal to change the multipliers of PGOV farm due to instability of the PGOV price, which influences the APRs.

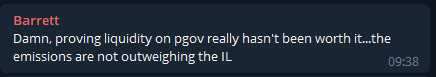

Price fluctuates strongly because of the low liquidity in the LP. Although this LP has a huge APR, there are not many people wanting to join. The reason is that even if the daily APR is over 10%, it doesn’t mean much when the price is falling 4x faster than the rewards are making up for it.

Let’s dive deeper and break down the rewards of 150 per block. Multipliers are used to distribute/divide these rewards among all the pools according to a certain ratio. Changing the multipliers doesn’t change the total amount of rewards released per block, it only changes the ratio.

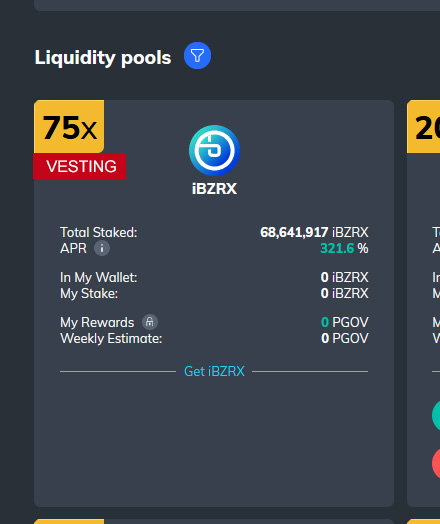

Currently there are 10 pools, of which only 2 are with locked/vested rewards, so they are not the ones who can sell.

The remaining pools have a combined multiplier of 85,5x.

LP only receives 20x, which is 23%. It will need to handle the selling pressure of the other 77%, which have a combined multiplier of 65,5x.

Low liquidity in the LP means the price greatly fluctuates, it can dump or rise very fast. If you don’t entice the LP with the highest multiplier, the experienced farmers are simply not going to join, meaning the liquidity stays low.

The LP multiplier of most projects have set it at the highest, it’s the most dangerous one with IL so it should be rewarded the most.

In this case we have BZRX as the highest, but it is locked/vested, so it’s not a problem (yet!), but the LP should at least be the highest of all the other unlocked pools.

There are a few possible solutions to this:

-

Increasing the multiplier of the LP due to the IL risk which is very obvious.

-

Decreasing the multipliers of the other unlocked pools (stablecoin only pools should not have such a high multiplier, it is risk-free farming and it mainly attracts farm and dumpers).

-

Setting a vesting schedule on every pool except the LP.

My proposal is a quick fix using only the multipliers, a combination of 1&2, because setting a vesting schedule is a big change of the rules and is going to be frowned upon by the community.

Propose:

Set LP multiplier to 30x.

Set Stablecoin multipliers to 5x.

New ratio: 46,5x unlocked pools, LP will get 65% of the unlocked rewards. This will boost and compensate the current LP stakers.

After enough liquidity has arrived and the stablecoin pools need a boost because of the high demand of stablecoins on fulcrum platform, we can increase the stablecoin multipliers to 10x. This will give LP 53% which should be a nice equilibrium until the vested pools come into play.

TL:DR

Edit after consultation with community members and to make it look better marketing-wise.

Proposal to change the PGOV farming multipliers as follows:

LP pool to increase from 20x to 60x.

The two stablecoin pools will drop to 10x each.

All other pools will remain unchanged.

This will make a ratio of 3:1 between the LP pool and the two stablecoin pools combined, and encourage liquidity to flow to the LP pool where it is currently needed much more to help with price stability and liquidity for PGOV than in the stablecoin pools which have more liquidity than required.

At a later stage the multipliers can be adjusted again if the any of the pools need to be incentivized more.

Yeah it definitely will be fixed if this gets implemented, but it needs to happen soon!

Yeah it definitely will be fixed if this gets implemented, but it needs to happen soon!